This is the first time Doosan Bobcat has held an Investor Day event since its listing on the Korea Exchange in 2016. The co-representative executives, CEO and CFO of Doosan Bobcat, presented the company’s key management strategies, 2024 financial performance, and 2025 outlook at the event.

CEO and Vice Chairman Scott Park, the first presenter, explained Doosan Bobcat’s growth strategy.

Park cited four core competencies that have established Doosan Bobcat as a leading manufacturer in the compact equipment sector:

- Product Excellence through a diversified portfolio, while offering the most attachments in the industry

- Global Sales Network based on solid partnerships

- Global Manufacturing Footprint optimized for the demand of each region

- Innovation Advancements that pioneered the compact equipment market and continue to accelerate it forward

Based on these competencies, Doosan Bobcat plans to drive future growth in the mature construction equipment market through M&A and innovation.

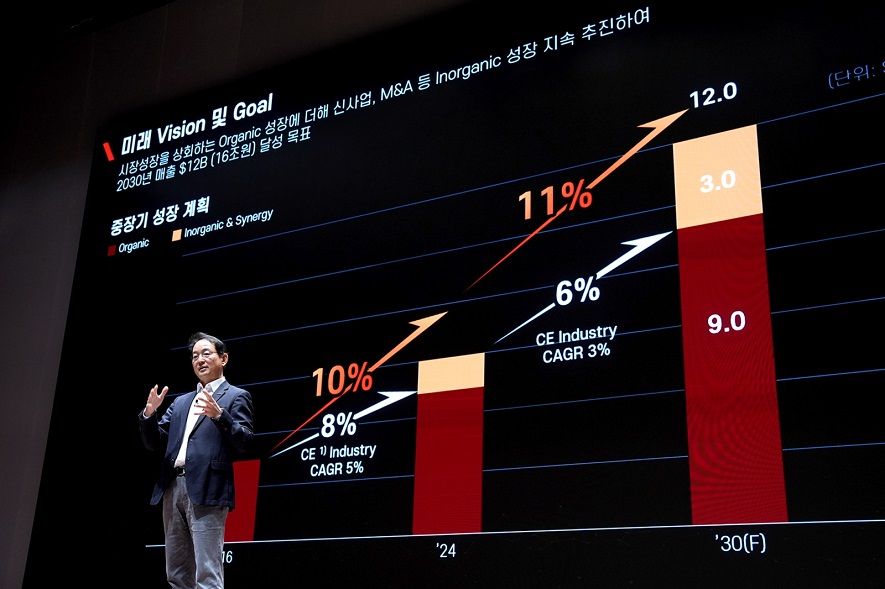

Park said, “Since our listing in 2016, both scale and profitability have doubled. Especially over the past five years—during which we actively pursued M&As—we achieved high growth with an annual average sales increase of 15% and an operating profit of 18%, through acquisitions in adjacent business areas such as mowers and forklifts.” He added, “Based on these successful experiences, we will continue to innovate and grow existing businesses while also pursuing inorganic growth through M&As to achieve an annual growth rate of 11%, driving toward our goal of 12 billion USD (16 trillion KRW) in revenue by 2030.”

▲Scott Park, Vice Chairman and CEO of Doosan Bobcat, announces growth strategy at the ‘Investor Day’ event.

Park’s presentation was followed by CFO and executive vice president Duckje Cho with last year’s annual performance and this year’s outlook.

In 2024, Doosan Bobcat recorded annual sales of 6.269 billion USD, a 16% decrease from 2023, and an operating profit of 639 million USD, a 40% decrease from 2023 results. (According to the KRW income statement, the decline was reduced to -12% and -37% respectively, due to the weaker KRW against the dollar.)

Cho said, “The compact construction equipment market is showing a gradual recovery and is expected to rebound from the second half of this year, with annual demand expected to be similar to 2024.” He provided guidance for 2025, forecasting annual sales of 6.4 billion USD and an operating profit of 600 million USD. This represents a 2% increase in sales and a 6% decrease in operating profit compared to last year. Additionally, he emphasized, “The shareholder return rate of 40% included in the value-up program announced in late 2024 marks the highest level in the Korean machinery industry.” He added that “we are nearing the completion of the promised 200 billion KRW share buyback, and a decision will be made to cancel the shares within a month.”

Source: Doosan Press Release

Comments