Announcement of the 5th National Pension Comprehensive Operation Plan… “We will create a reform plan together with the people.”

A blueprint for pension reform, one of the government’s three major reform tasks, has been released.

We are pushing for a plan to increase the national pension insurance premium rate, but apply a different pace of insurance premium rate increase taking into account equity across generations.

In addition, the government allayed public concerns by legislating that the government would pay even if the pension fund was depleted, and focused on strengthening retirement income security by increasing the basic pension by 400,000 won.

In addition, it includes measures to strengthen equity in line with changes in population structure, such as expanding credits for childbirth and military service.

The Ministry of Health and Welfare held the 3rd National Pension Deliberation Committee on the 27th and reviewed the 5th National Pension Comprehensive Operation Plan (draft) containing these contents.

The comprehensive operation plan is the government’s pension reform plan that is mandatorily established based on financial calculations every five years in accordance with the National Pension Act. This bill will be submitted to the National Assembly by the end of this month after passing the Cabinet meeting on the 30th.

Minister of Health and Welfare Cho Gyu-hong said, “The government’s plan will be the starting point for a full-scale social discussion on pension reform,” and added, “We will work closely with the National Assembly and create a reform plan with the people through social discussions.”

◆Suggestion of direction for insurance premium rate and income replacement rate

This comprehensive national pension operation plan (draft) did not include a specific adjustment plan for the insurance premium rate (money paid) and income replacement rate (money received), but the direction was presented.

The Ministry of Health and Welfare said, “As there are various opinions on insurance premium rates and income replacement rates, rather than presenting a specific plan, we presented a direction so that a broad discussion can take place through the public deliberation process,” and added, “The specific levels of insurance premium rates and income replacement rates will be determined through the National Assembly and public deliberation process.” “We plan to do it,” he explained.

The comprehensive operation plan makes it clear that, compared to OECD member countries, the income replacement rate is similar, but the insurance premium rate is half the level, so a gradual increase in the insurance premium rate is inevitable to improve sustainability.

It was decided to specify the level of increase through public discussion, but to differentiate the rate of increase in insurance premiums by age group in consideration of generational equity.

The plan is to review the adjustment of the nominal income replacement rate related to security in connection with discussions on structural reform within the framework of multi-layered retirement income security such as basic pension and retirement pension. As opinions vary, we will collect opinions on specific levels during the public deliberation process.

In addition, it was emphasized that when the nominal income replacement rate is raised, an increase in the insurance premium rate is inevitable to improve sustainability, so it is necessary to consider the burden on future generations.

Additional adjustments to the starting age for national pension benefits were also left to be discussed. According to the current adjustment plan, the age will be raised by one year every five years, from 63 in 2023 to 64 in 2028 and 65 in 2033.

The Ministry of Health and Welfare said that discussions on additional adjustments to the pension start age will begin after conditions for continued employment for the elderly mature, taking into account the widening income gap after retirement. They also discussed ways to improve consistency with other pension systems, such as the national pension start age, basic pension, and retirement pension. He announced that he plans to leave.

◆Abolition of old-age pension reduction system and stipulation of payment guarantee

This comprehensive operation plan contains several institutional improvement plans in addition to directions for insurance premium rates, income replacement rates, and adjustment of the age at which benefits begin to be received.

First, we will pursue a plan to convert special workers and platform workers into national pension business subscribers. It was decided to discuss through fact-finding surveys those with a high possibility of identifying and managing income, and to ease the burden on the remaining occupations by expanding insurance premium support for local subscribers.

In addition, the upper age limit for mandatory national pension subscription is sequentially aligned with the pension start age.

The system that reduces the pension of economically active national pension recipients is in the process of being abolished. In other words, the national pension will not be reduced even if you work after retirement.

The survivor pension is subdivided according to the subscription period by increasing the payment rate from the existing ’40~60%’ to ’50~60%’, and the age of grandchildren is also raised from the current ’19’ to ’25’ to improve the level of coverage and payment target. Also expand.

The government is pushing for the ‘stipulation of guaranteed payment’ in order to allay the youth generation’s anxiety about their pension finances. This is a method of specifying in relevant laws that the state guarantees the payment of national pension.

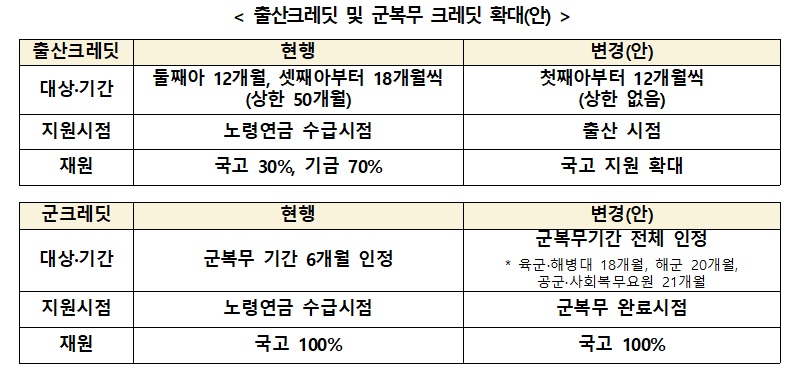

The credit system will also be improved to strengthen compensation for activities with social value, such as childbirth and military service, that are borne by the young generation.

The credit system provides additional recognition for the period of national pension subscription. Currently, maternity credit is recognized starting from the second child, but the system is designed to recognize it for 12 months starting from the first child in the future. The recognition period for military service credit will also be expanded from the current 6 months to the entire service period.

What attracts attention this time is the significant strengthening of retirement income security for the elderly.

The Ministry of Health and Welfare said, “After the introduction of the basic pension, the poverty rate among the elderly has been continuously alleviated, but it is still three times higher (37.6%) than the Organization for Economic Development and Cooperation (OECD) average.”

The basic pension is paid to seniors aged 65 or older who are in the bottom 70% of income brackets.

Accordingly, the basic pension amount will be gradually increased to 400,000 won to alleviate elderly poverty.

However, the specific timing and method of increase will be discussed in connection with national pension reform.

◆Push to increase fund return rate by more than 1%p

The government also set a goal of increasing the fund management rate of return from 4.5% to 1 percentage point to ensure financial stability of the National Pension Fund.

To this end, we plan to increase expertise by transferring the National Pension Service’s asset allocation authority from the Fund Management Committee, which includes representatives of employers and workers, to the Fund Management Headquarters.

In addition, the investment network will be strengthened by establishing a Seoul office (Seoul Smart Work Center) of the fund management headquarters located in Jeonju.

Through this, the fund’s overseas investment proportion will be expanded to 60% by 2028, and the number of personnel in alternative investments (real estate, private equity funds, etc.) will be significantly increased from 2024.

Long-term fund management goals are set and an asset allocation system that facilitates investment diversification, such as expansion of alternative investments, is also established.

Inquiries: National Pension Policy Division, Ministry of Health and Welfare (044-202-3613)

Ministry of Health and Welfare

Source: Policy news, link

Comments

Great updated info from Korea.