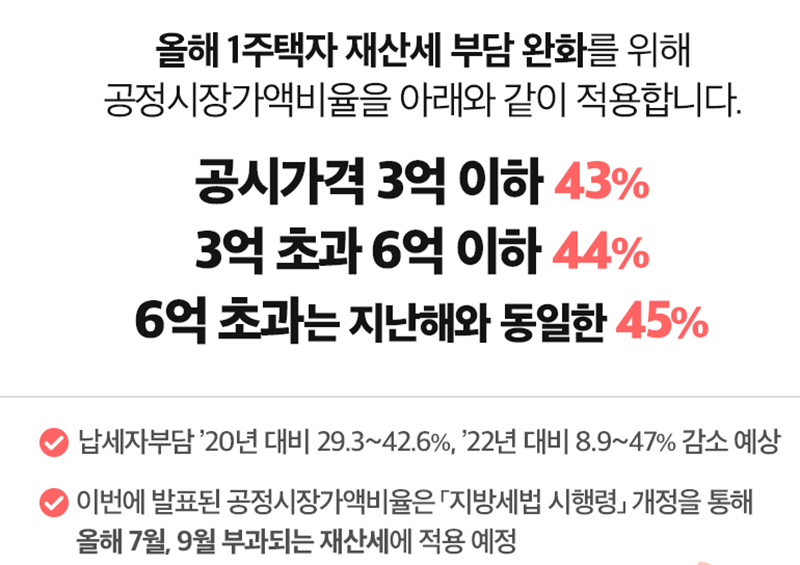

This year, the burden of property tax on a single homeowner is expected to decrease by 29.3% to 42.6% compared to 2020 and by 8.9% to 47% compared to 2022.

The Ministry of Public Administration and Security lowered the fair market value ratio, which was temporarily lowered last year to ease the property tax burden for single homeowners, by 43% for the official price of 300 million or less, 44% for 300 million or more and 600 million or less, and 45% for more than 600 million, the same as last year. It was announced on the 2nd that it would be applied.

This year, the official price of multi-family housing has decreased compared to the previous year, so even if applied the same as last year, the tax burden will be reduced.

Meanwhile, the fair market value ratio for multi-homed people and corporations is planned to be applied at the same level as last year at 60%.

.jpg)

As the fair market value ratio for single-homeowners is set at 43-45% this year, the tax burden on taxpayers is expected to decrease by 29.3%-42.6% compared to 2020 and by 8.9-47% compared to 2022.

For example, the property tax on a house with an official price of 200 million won last year was 198,000 won, but this year, the official price fell to 190 million won, and the tax amount decreased by 23,000 won (11.6%) to 175,000 won.

In addition, the property tax for a house with an official price of 500 million won last year was 639,000 won, but this year, the official price fell to 420 million won, and the tax amount decreased by 154,000 won (24.1%) to 485,000 won.

The decrease in tax amount compared to 2022 is greater than that in 2020 because there was no reduction in the fair market value ratio for single homeowners in 2020 (applied 60%), and there was no special tax rate for single homeowners applied from 2021.

The decrease in property tax from the previous year for houses under 300 million or between 300 million and 600 million was smaller than for houses over 600 million, because the decline in the official price of houses under 600 million, which had been relatively small, was relatively small this year. because

In addition, it is analyzed that the tax rate (0.05-0.2%) applied to houses under 600 million is smaller than the tax rate (0.05-0.4%) applied to houses over 600 million, so the change in tax amount due to the decrease in the official price is small.

Meanwhile, the expected housing property tax revenue this year is 5,679.8 billion won, down 1.04 trillion won (15.0%) from last year’s 6,683.8 billion won.

Of this, 727.5 billion won (72.5%) is expected to go to the tax burden reduction benefit for single homeowners, which is an average of 72,000 won per household, based on 10.08 million single homeowners.

In addition, the expected housing property tax revenue this year is a decrease of 92.3 billion won (1.6%) from 5,772.1 billion won in 2020.

Vice Minister of Public Administration and Security Han Chang-seop said, “By lowering the fair market value ratio for single homeowners under 600 million this year, it is expected that it will be able to contribute to the stabilization of housing for the common people amid difficult economic conditions of high prices and high interest rates.”

Meanwhile, the government will make a legislative notice of the announced fair market value ratio on the 8th through the amendment to the Enforcement Decree of the Local Tax Act, complete the revision process within the next month, and apply it from the property tax imposed in July and September.

Inquiries: Real Estate Tax Division (044-205-3845), Local Finance and Economy Office, Ministry of Public Administration and Security

Ministry of Public Administration and Security

Source: Policy news, link

Comments